联系我们

地址

Level 7

68-70 Shortland Street, Auckland 1010

办公室

纽西兰: 0800 338 838

澳洲: 1800 143 415

美国: 1888 6257 833

英国: 0800 0285 834

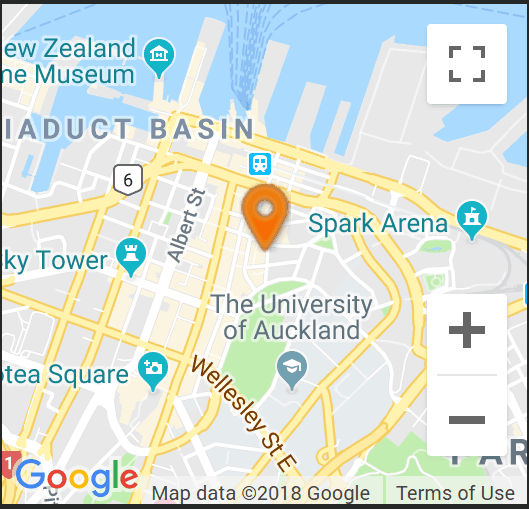

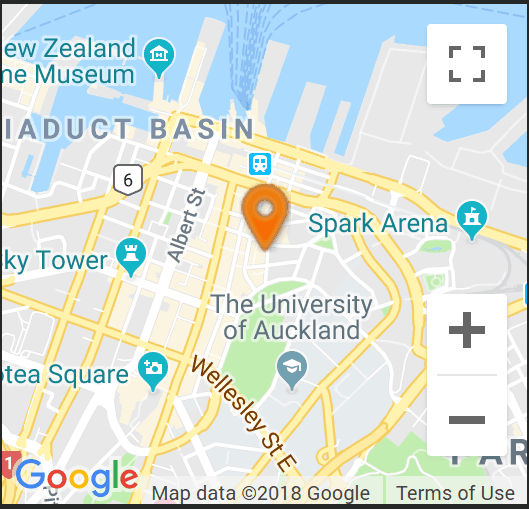

找到我们

为了获得最佳停车位,请使用Chancery停车场。

地址

Level 7

68-70 Shortland Street, Auckland 1010

办公室

纽西兰: 0800 338 838

澳洲: 1800 143 415

美国: 1888 6257 833

英国: 0800 0285 834

Comm:隔夜市场 英国和挪威维持利率不变,瑞士继续降息

新西兰元 GDP 增长超出预期,第一季度增长 0.2%,反映出大规模移民的影响。新西兰经济虽然脱离技术性衰退,但仍处于低迷状态。今日市场等待亚洲、欧洲和北美的 PMI 数据。

The Bank of England and the Norges Bank both left interest rates unchanged, in line with expectations, while the Swiss National Bank cut 25 basis points. The SNB lead the way in Europe, with interest rate cuts, while the Bank of England hold despite hitting the 2% target range for inflation. The BoE would be reluctant to act before the election, July 4th, while a cut is expected in August. Economic conditions in Europe certainly demand rate cuts, while things are deteriorating fast across the Atlantic, in the USA. Building Permits and Housing Starts both suffered sharp falls, while the Philly Fed Manufacturing Index was also in decline. The political uncertainties across Europe are materialising fast, as economies suffer recession and Geo-Political pressures build, ominously. The Bank of England moves heralded a decline in the GBP, falling to 1.2660, while the EUR held 1.0700.

NZD GDP growth beat expectations, rising 0.2% for Q1, a reflection of massive immigration. The NZ economy is out of the technical recession but remains very much depressed. Markets await PMI data from Asia, Europe and North America in today’s trade.

分享这个帖子