联系我们

地址

Level 7

68-70 Shortland Street, Auckland 1010

办公室

纽西兰: 0800 338 838

澳洲: 1800 143 415

美国: 1888 6257 833

英国: 0800 0285 834

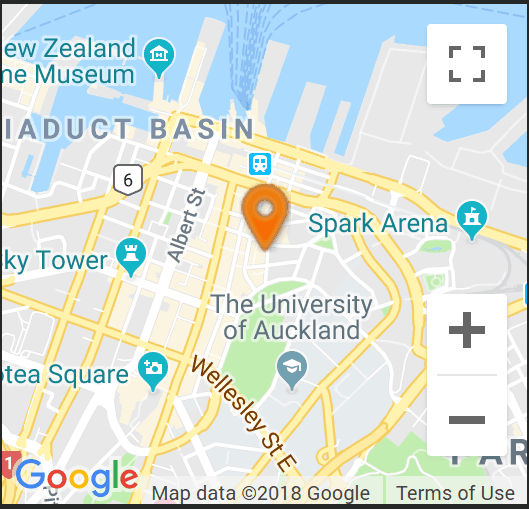

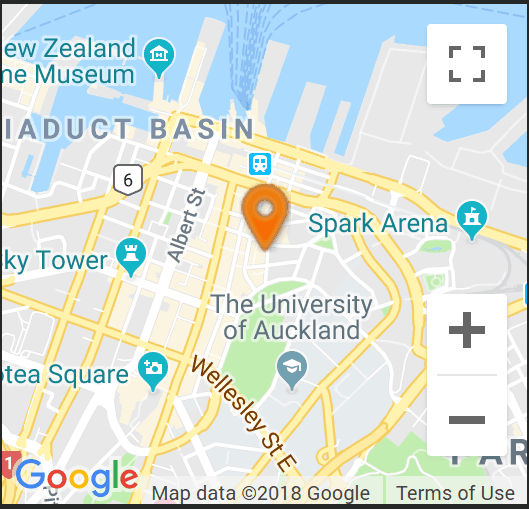

找到我们

为了获得最佳停车位,请使用Chancery停车场。

地址

Level 7

68-70 Shortland Street, Auckland 1010

办公室

纽西兰: 0800 338 838

澳洲: 1800 143 415

美国: 1888 6257 833

英国: 0800 0285 834

隔夜市场 等待FOMC会议

美联储利率决定前,澳元交易价在 0.6600 左右,而新西兰元则在 0.6100 上方盘整。欧洲的注意力仍然集中在经济增长和通胀上,而整体市场则专注于美联储。

The two-day FOMC meeting began today, with market attention focused on the Federal Reserve rate decision and accompanying commentary. Market expectations for a cut are almost zero, while the expected rate cut later in the year, appears less and less likely. Inflation remains stubbornly high, and the Fed is committed to winning this war, before any cuts can be instituted. The ECB has taken that step, as the recession in Europe has effectively managed the inflation crises. The US avoided recession, through massive fiscal and monetary stimulus, flagging the most effective inflation killer. If the Fed decide to hold rates, higher for longer, this will add pressure to markets and debt holders. Banks with high volumes of US debt, will come under pressure, as will a particular Country. The UK Unemployment rate jumped to 4.4%, from 4.3%, but wage growth spiked 6% for the three-month period. This will be a major concern for the Bank of England and issue doubts over future rate cuts. The GBP was supported by the news, trading 1.2750, while the EUR drifted to 1.0750.

The inaction from the reserve ahead of the Fed’s rate decision, allowed the AUD to trade around 0.6600, while the NZD consolidated above 0.6100. Europe’s attention remains on growth and inflation, while overall the markets, are preoccupied with the Fed.

分享这个帖子