联系我们

地址

Level 7

68-70 Shortland Street, Auckland 1010

办公室

纽西兰: 0800 338 838

澳洲: 1800 143 415

美国: 1888 6257 833

英国: 0800 0285 834

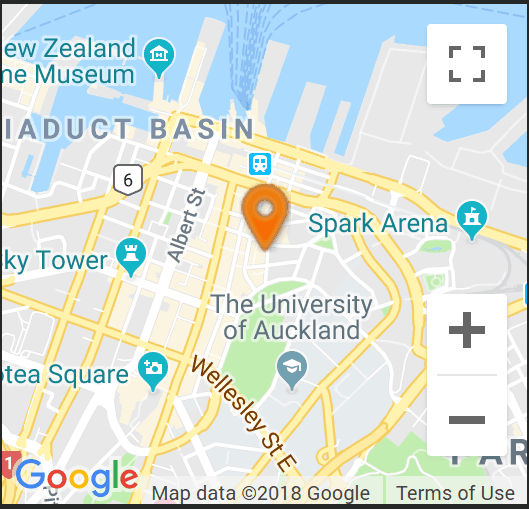

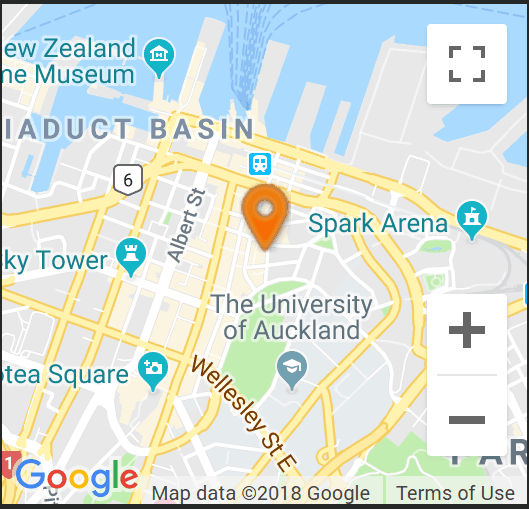

找到我们

为了获得最佳停车位,请使用Chancery停车场。

地址

Level 7

68-70 Shortland Street, Auckland 1010

办公室

纽西兰: 0800 338 838

澳洲: 1800 143 415

美国: 1888 6257 833

英国: 0800 0285 834

隔夜市场 欧洲通胀仍持续

澳大利亚央行维持利率不变,并声称正在考虑加息,因为通胀仍然是一个严重的问题。考虑到大量移民涌入,这并不令人意外。央行言论足以支撑澳元,澳元回升至 0.6650,而纽元则在 0.6100 上方盘整。当地市场将关注今天的日本短观报告、日本贸易和日本央行会议纪要,而新西兰经常账户预计将大幅负增长。在英格兰银行最新利率决定公布之前,英国通胀数据也将成为市场关注焦点。

European CPI data confirmed a rise in inflation, following the ECB’s rate cut, which does not auger well. The recessionary conditions, that have savagely cut inflation continue, but inflation remains stubbornly high. The economic environment that triggered the surge in inflation, remain in place, with record deficits and debt and energy prices remaining prohibitively high. The EU ZEW Economic Sentiment report was a positive and pushed up above the key 50 level, while Germany’s ZEW Economic Sentiment remained gloomy. US Retail Sales remain depressed, while Industrial and Manufacturing Production turned slightly positive. Manufacturing in both Europe and the US remain heavily depressed. The softer numbers lead to softer bond yields and US Dollar, with the EUR pushing up to 1.0730, while the GBP trades around 1.2700.

The RBA left rates unchanged and confirmed an interest rate rise was considered, as inflation remains a serious problem. It is not a surprise considering the massive immigration inflows. This was enough to underwrite the AUD, which pushed back up towards 0.6650, while the NZD consolidates above 0.6100. Local markets will look at the Japanese Tankan report, Japanese Trade and the BoJ minutes today, while the NZ Current Account is expected to remain heavily negative. UK inflation data will also be a focus ahead of the latest Bank of England rate decision.

分享这个帖子