联系我们

地址

Level 7

68-70 Shortland Street, Auckland 1010

办公室

纽西兰: 0800 338 838

澳洲: 1800 143 415

美国: 1888 6257 833

英国: 0800 0285 834

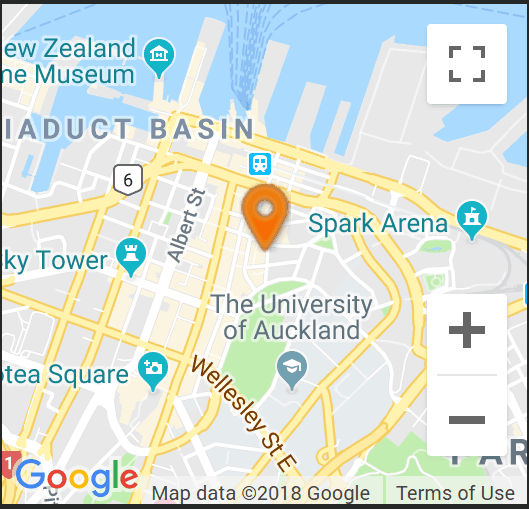

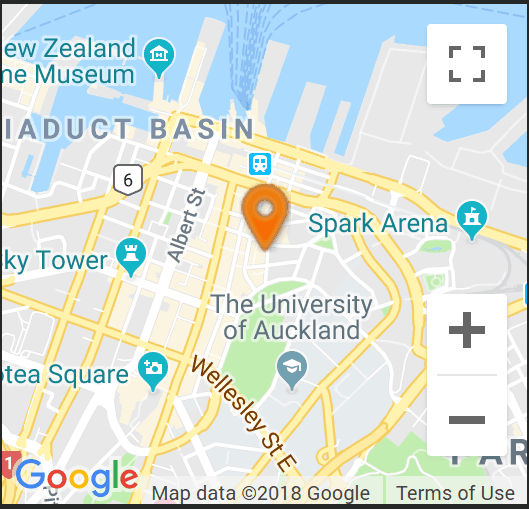

找到我们

为了获得最佳停车位,请使用Chancery停车场。

地址

Level 7

68-70 Shortland Street, Auckland 1010

办公室

纽西兰: 0800 338 838

澳洲: 1800 143 415

美国: 1888 6257 833

英国: 0800 0285 834

隔夜市场 欧洲跌势暂歇

在澳大利亚央行最新利率决定公布之前,大宗商品市场保持稳定。预计澳大利亚央行将维持利率不变,而评论将是关键。预计该行将在持续的抗击通胀中保持鹰派立场。新西兰 PSI 和 PCI 数据大幅下跌,深陷收缩区间,反映了经济环境。中国工业生产和零售额保持强劲,而中国人民银行一年期利率保持不变。

European equity markets rebounded from last Friday’s losses, that were triggered by the Political upheaval in Europe, especially France. The political volatility looks set to continue, as France and the UK head to the Polls and changes are expected. It may not be long before other incumbent leaders are forced to face the will of the people. High inflation, falling standards of living and persistent high inflation and interest rates are not welcome. Markets will be watching European inflation data, set to be released today, while the Bank of England rate decision will be the focus later in the week. The EUR remains weak, trading around 1.0700, while the GBP looks to regain 1.2700.

Commodity markets remain stet, ahead of the latest RBA interest rate decision. The RBA is expected to leave rates unchanged, while the commentary will be key. The Bank is expected to remain hawkish in the ongoing fight against inflation. NZ PSI and PCI numbers fell sharply, deep into contraction territory, reflecting the economic environment. Chinese Industrial Production and Retail Sales remain strong, while the PBoC 1-year rates unchanged.

分享这个帖子