联系我们

地址

Level 7

68-70 Shortland Street, Auckland 1010

办公室

纽西兰: 0800 338 838

澳洲: 1800 143 415

美国: 1888 6257 833

英国: 0800 0285 834

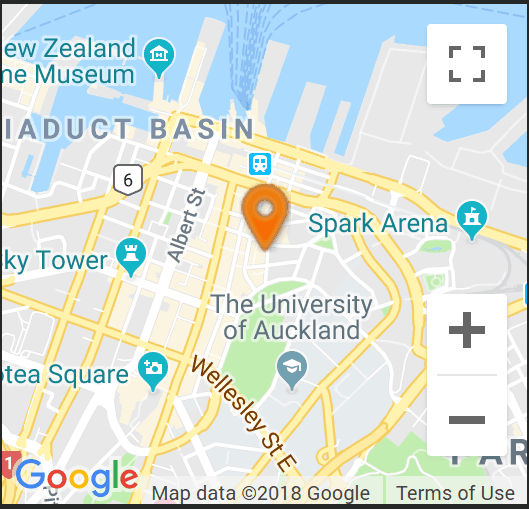

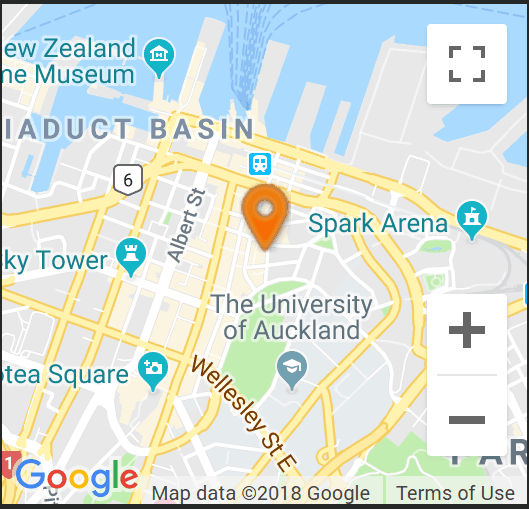

找到我们

为了获得最佳停车位,请使用Chancery停车场。

地址

Level 7

68-70 Shortland Street, Auckland 1010

办公室

纽西兰: 0800 338 838

澳洲: 1800 143 415

美国: 1888 6257 833

英国: 0800 0285 834

隔夜市场 欧洲消费信心指数下跌,市场下行

商品货币也遭遇压力,澳元交易价低于 0.6650,而新西兰元跌破 0.6100。新西兰商业信心数据将于今日公布,而美国市场将关注GDP增长和通胀。

European equity markets dipped lower overnight, following Consumer Confidence readings in both Germany and France. German Consumer Confidence, in particular tumbled sharply, undermined by the political insecurities embracing Europe. US New Home Sales contracted, as Building Permits also retreated, confirming the weakness in the housing sector. US Markets are focused on inflation, with the Fed’s preferred measure, the PCE, set to be released tomorrow. Inflation is expected to rise again, in the US, which will dampen the likelihood of any interest rate cuts. High interest rates keep the pressure on all sectors and should be reflected in equity and bond markets. Bond Yields rose in Europe and the US overnight. The EUR dipped back below 1.0700, struggling, while the GBP may test the lows of 1.2600.

Commodity currencies also suffered the bounce in the reserve currency, with the AUD trading below 0.6650, while the NZD crashed under 0.6100. NZ Business Confidence data will be released today, while US markets will focus on GDP growth and inflation.

分享这个帖子