联系我们

地址

Level 7

68-70 Shortland Street, Auckland 1010

办公室

纽西兰: 0800 338 838

澳洲: 1800 143 415

美国: 1888 6257 833

英国: 0800 0285 834

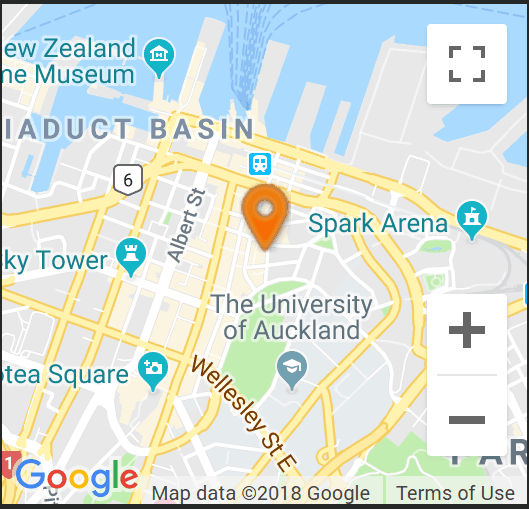

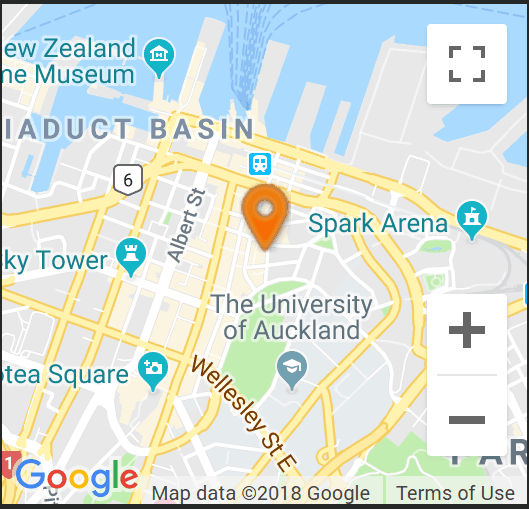

找到我们

为了获得最佳停车位,请使用Chancery停车场。

地址

Level 7

68-70 Shortland Street, Auckland 1010

办公室

纽西兰: 0800 338 838

澳洲: 1800 143 415

美国: 1888 6257 833

英国: 0800 0285 834

隔夜市场 欧洲央行开始降息,市场平静应对

欧洲央行的行动对大宗商品货币影响不大,纽元交易价略低于 0.6200,而澳元则回升至 0.6650。澳大利亚贸易顺差继续,但出口和进口均出现下降,而市场正在等待今天中国的关键贸易数据。今晚美国将公布的非农就业数据预计将显示劳动力市场疲软。

The ECB cuts rates for the first time in five years, as expected, offering relief to borrowers. This has been an exercise in economics, that the best cure for inflation, is recession. The US, Canada and Australia/NZ are also employing this ‘tried, tested and proven’ economic strategy. The pain for borrowers is set to continue in the US, Australia and New Zealand. Markets anticipate that the ECB will cut again, at least once, this year. The Fed is not expected to consider cuts until later in the year and the RBA and RBNZ are projecting no relief until 2025. This was an entirely expected move from the ECB and markets hardly moved. Bond yields drifted lower and currencies tread water. The EUR traded 1.0870, while the GBP still looks to hit 1.2800, once again.

The ECB actions had little impact on commodity currencies, with the NZD trading just below 0.6200, while the AUD regained 0.6650. The Australian trade surplus continued, but with falls in both exports and imports, while markets await today’s key trade data from China. The important Non-Farm Payroll number, set to be released in the US tonight, is expected to show a weaker labour market.

分享这个帖子