联系我们

地址

Level 7

68-70 Shortland Street, Auckland 1010

办公室

纽西兰: 0800 338 838

澳洲: 1800 143 415

美国: 1888 6257 833

英国: 0800 0285 834

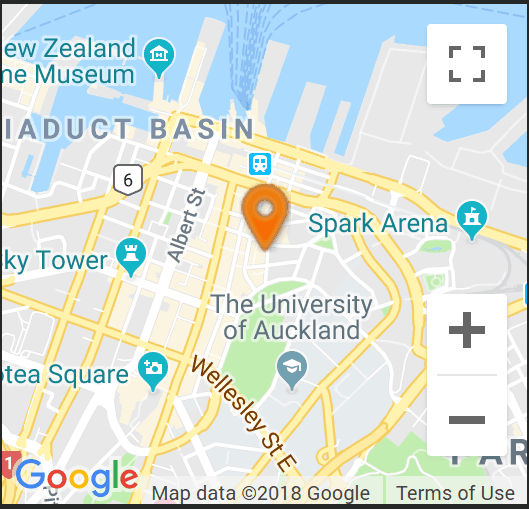

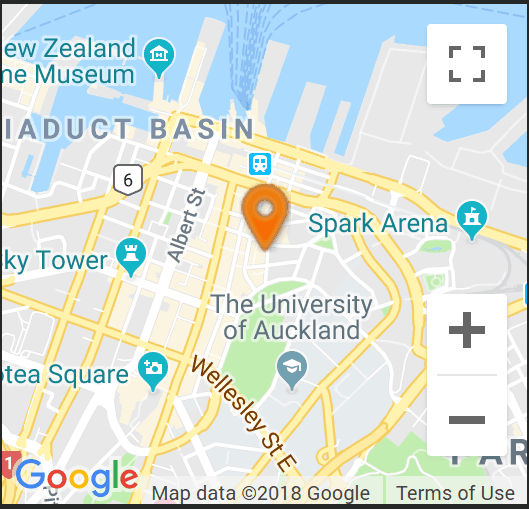

找到我们

为了获得最佳停车位,请使用Chancery停车场。

地址

Level 7

68-70 Shortland Street, Auckland 1010

办公室

纽西兰: 0800 338 838

澳洲: 1800 143 415

美国: 1888 6257 833

英国: 0800 0285 834

隔夜市场 整体向右

大宗商品货币仍面临压力,新西兰元交易价低于 0.6100,而澳元徘徊在 0.6650 左右。日元是承受压力最大的货币,创下 1986 年以来的最低点,跌至 161.27。未来一周,市场将关注欧洲的通胀,而美国市场将密切关注就业数据。本周将发布一系列就业报告,周五将发布非农就业数据。本周可能开局强劲,但美国独立日假期恰逢周四。许多人将享受四天的假期,因此交易周将非常短暂。

The much-anticipated PCE inflation indicator came in exactly as forecast, at 2.6%. This expected inflation level, did nothing for market direction, but Bond Yields jumped higher in Europe and the USA. This points to a market perception that the Fed will not be cutting rates any time soon. UK GDP numbers came in positive, as expected, ending the technical recession. This was a much-needed boost for the flailing Conservative Government, ahead of an expected bloodbath election for the Tories, this coming week. French Parliamentary elections also promise a bloodbath for the Macron Government, which could have consequences throughout Europe. The political tide is turning in Europe and the USA. The EU elections showed an emerging right of Centre political bias, which was also a trend confirmed in the US with the Presidential debate. The ‘sharp and quick witted’ Biden confirmed what most knew, he is living in a demented world and should not be leading the USA. The EUR held around 1.0700, while the GBP drifted back to 1.2620, despite the improvement in GDP growth.

Commodity currencies remain under pressure, with the NZD trading below 0.6100, while the AUD hovers around 0.6650. The Yen is the currency under the most pressure, hitting lows not seen since 1986, plunging to 161.27. This coming week will see a focus on inflation in Europe, while US markets will be watching employment numbers closely. A series of employment reports will be coming out this week, culminating in Non-Farm Payrolls, released Friday. The week may start off strongly, but the Independence Day holiday in the US, falls on Thursday. Many will take a four-day weekend, thus ensuring a very short trading week.

分享这个帖子