联系我们

地址

Level 7

68-70 Shortland Street, Auckland 1010

办公室

纽西兰: 0800 338 838

澳洲: 1800 143 415

美国: 1888 6257 833

英国: 0800 0285 834

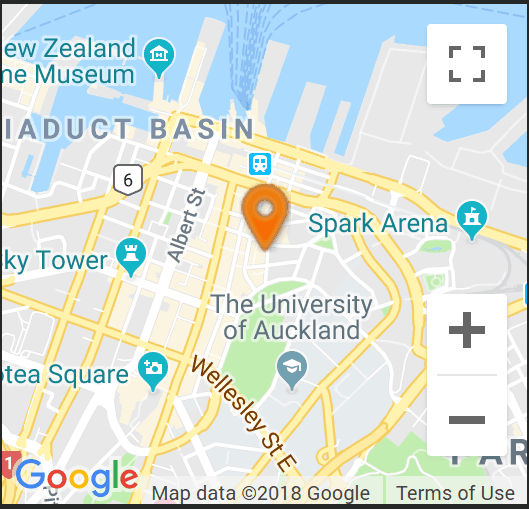

找到我们

为了获得最佳停车位,请使用Chancery停车场。

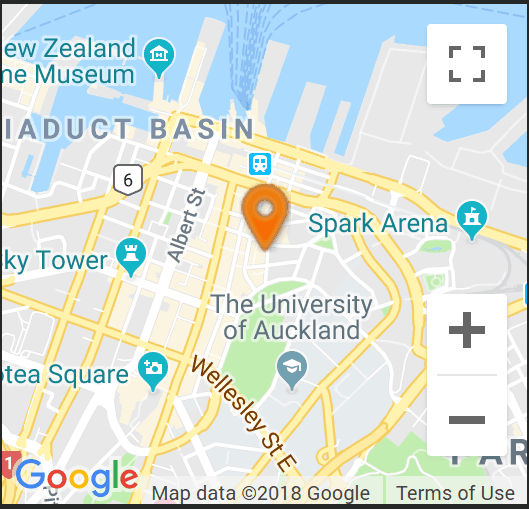

地址

Level 7

68-70 Shortland Street, Auckland 1010

办公室

纽西兰: 0800 338 838

澳洲: 1800 143 415

美国: 1888 6257 833

英国: 0800 0285 834

隔夜市场 政治局势左右环球市场

大宗商品货币承压,纽元回落至 0.6100,而澳元在澳大利亚央行 IRD 之后收复部分失地,澳元回升至 0.6650,此前澳大利亚央行发表了非常鹰派的评论,称他们考虑进一步加息。本周,市场将关注经济增长和通胀,欧洲和美国都将公布重要数据。市场注意力将集中在美国个人消费支出 (PCE) 通胀指标上,该指标将于本周晚些时候公布。

An anticlimactic close to a very politically volatile week, as election repercussions, permeate markets. UK and French snap elections, follow the European elections, which will see a significant shift away from incumbents. PMI data from Europe remain extremely challenging with deep contractions in Manufacturing. US and Asian PMI was also weaker, but not as dramatically so, as in Europe. Political uncertainty is causing nervous volatility in markets, despite US equity markets trading around record highs. Geo-Political developments have the potential to upend markets. The US Dollar closed out the week steady, with the EUR trading around 1.0700, while the GBP drifted back to 1.2640.

Commodity currencies are under pressure, with the NZD falling back to 0.6100, while the AUD regained some lost ground following the RBA IRD The AUD rose back to 0.6650, following the very hawkish commentary from the RBA, where they considered a further rate rise. This coming week will be focused on growth and inflation, with key readings in both Europe and the USA. Market attention will be firmly focused on the important US PCE inflation indicator, set to be released late in the coming week.

分享这个帖子