联系我们

地址

Level 7

68-70 Shortland Street, Auckland 1010

办公室

纽西兰: 0800 338 838

澳洲: 1800 143 415

美国: 1888 6257 833

英国: 0800 0285 834

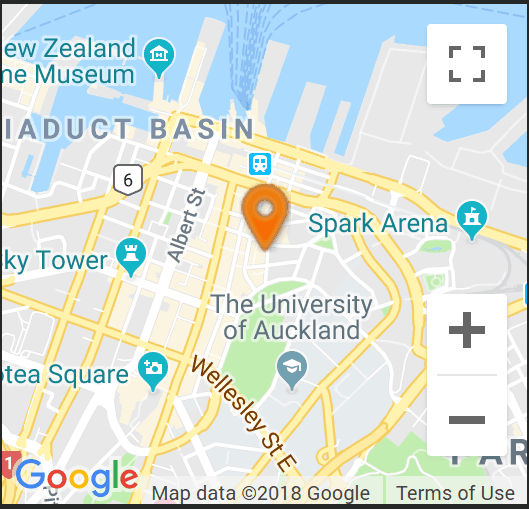

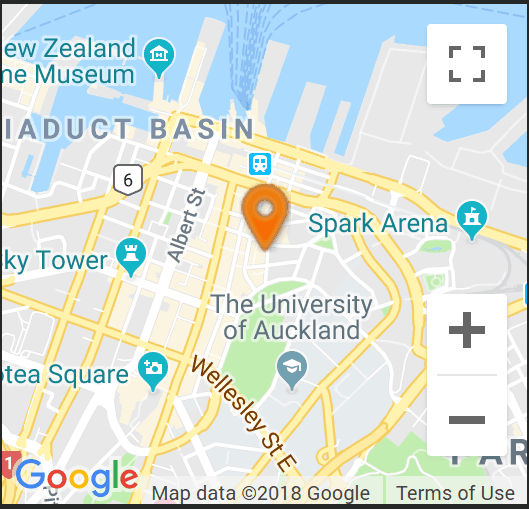

找到我们

为了获得最佳停车位,请使用Chancery停车场。

地址

Level 7

68-70 Shortland Street, Auckland 1010

办公室

纽西兰: 0800 338 838

澳洲: 1800 143 415

美国: 1888 6257 833

英国: 0800 0285 834

隔夜市场 市场等待欧洲央行发布降息声明

美元走软使得商品货币继续上涨,新西兰元接近 0.6200,而澳元有望重回 0.6650。澳大利亚第一季度的 GDP 勉强为正,增长 0.1%,年化增长率为 1.1%。尽管有大量创纪录的移民推动了增长,但这些增长数字仍然保持不变。如果没有创纪录的移民,这些数据将陷入严重困境,因为移民正在造成房地产市场的混乱并增加通胀压力。财政管理不善加剧了正在发展的经济危机,而新西兰也存在同样的问题。尽管出口和进口价格走弱,但新西兰第一季度的贸易条件指数上涨了 5.1%,这只能靠交易量的激增来挽救。现在所有人的目光都转向欧洲央行和其降息声明。

European markets returned to positive territory, once again, ahead of the all-important ECB meeting tonight. The ECB is expected to finally relent and cut interest rates, although the narrative will be watched closely, as interest rates in the EU spiked recently. Service PMI data in Europe was positive, although remaining lethargic, while US PMI data surged strongly. The ADP Jobs report added 152,000 jobs, much lower than expected (175,000), and in line with the Jolts reports. The weaker labour market is deflationary and an added incentive for the Fed to consider rate cuts. Weak manufacturing conditions, in both Europe and the USA, are translating into the labour market. Bond Yields continue to soften, on both sides of the Atlantic, allowing the weaker US Dollar to boost the EUR to 1.0870, while the GBP approaches 1.2800.

The softer reserve currency allowed commodity currency gains to continue, with the NZD approaching 0.6200, while the AUD looks to regain 0.6650. Australian GDP was barely positive in Q1, coming in at 0.1% growth, annualised to 1.1%. These growth numbers are despite massive and record immigration boosting numbers. The data would be in severe trouble without the record immigration, which is causing mayhem in the housing markets and adding to inflationary pressures. Fiscal mismanagement adds to the economic crises that is developing, while the same issues are in place across the Tasman. NZ Terms of Trade jumped 5.1% for Q1, despite weaker export and import prices, only saved by a surge in volumes. All eyes now turn to the ECB and rate cuts.

分享这个帖子