联系我们

地址

Level 7

68-70 Shortland Street, Auckland 1010

办公室

纽西兰: 0800 338 838

澳洲: 1800 143 415

美国: 1888 6257 833

英国: 0800 0285 834

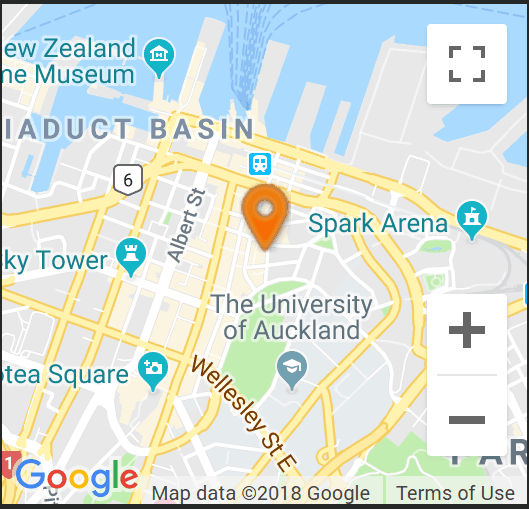

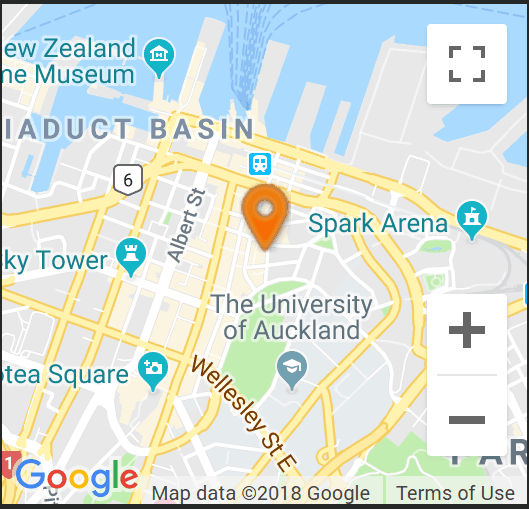

找到我们

为了获得最佳停车位,请使用Chancery停车场。

地址

Level 7

68-70 Shortland Street, Auckland 1010

办公室

纽西兰: 0800 338 838

澳洲: 1800 143 415

美国: 1888 6257 833

英国: 0800 0285 834

欧洲通胀因经济衰退而下降

美国就业岗位增加,与近期趋势相反,进一步考验美联储。美联储目前似乎在寻找推迟降息的借口,因此劳动力市场的任何收紧都会产生导致对应的效果。市场将关注亚洲、欧洲和美国即将发布的服务业和综合 PMI 数据,美国就业数据的影响将因独立日假期延长而得到缓解。

European inflation continued to move in the right direction, ensuring further rate cuts from the ECB this year. Inflation has been tamed by a deep and extended recession, falling to 2.5%, from 2.6%. European equity markets dipped lower as further political disruption is expected on July 4th, US Independence Day, which the British Tory Government had decided to face the electoral music. Yet another ‘woke’, globalists Government is about to be decimated by the people, who reject globalism, mass immigration, inflation and recession. The medicine is likely to be more dangerous than the illness, as the likely incoming Labour Government is probably going to be far worse, if at all possible. The EUR traded around 1.0740, while the GBP pushed up to 1.2680, ahead of the election.

US Job adds expanded, against recent trends, further testing the Fed. The Fed is looking for excuses to hold off on rate cuts, so any tightening in the labour market will do that. Markets will follow Services and Composite PMI data set to be released across Asia, Europe and the US. The impact of key US employment data will be cushioned, by the extended Independence Day holiday weekend.

分享这个帖子